santa clara county property tax collector

An escape assessment is a correction to a personal propertys assessed value that the Assessors Office of the County of Santa Clara did not add to any prior years Annual Unsecured Property Tax Bill. When contacting Santa Clara County about your property taxes make sure that you are contacting the correct office.

This translates to annual property tax savings of approximately 70.

. Enter Property Parcel Number APN. Due Date for filing Business Property Statement. Select Alley Avenue Blvd Circle Commons Court Drive Expressway Highway Lane Loop Parkway Place Road Square Street Terrace Trail.

MondayFriday 800 am 500 pm. TAX COLLECTOR HOURS OF OPERATION. News and World Report.

TELEPHONE AND EMAIL CUSTOMER SERVICE. Santa Clara County Assessor 70 West Hedding St. 831 454-2510 Monday Friday 800 am 500 pm.

View and pay for your property tax billsstatements in Santa Clara County online using this service. Currently you may research and print assessment information for individual parcels free of charge. Last Day to file Business Property Statement without 10 Penalty.

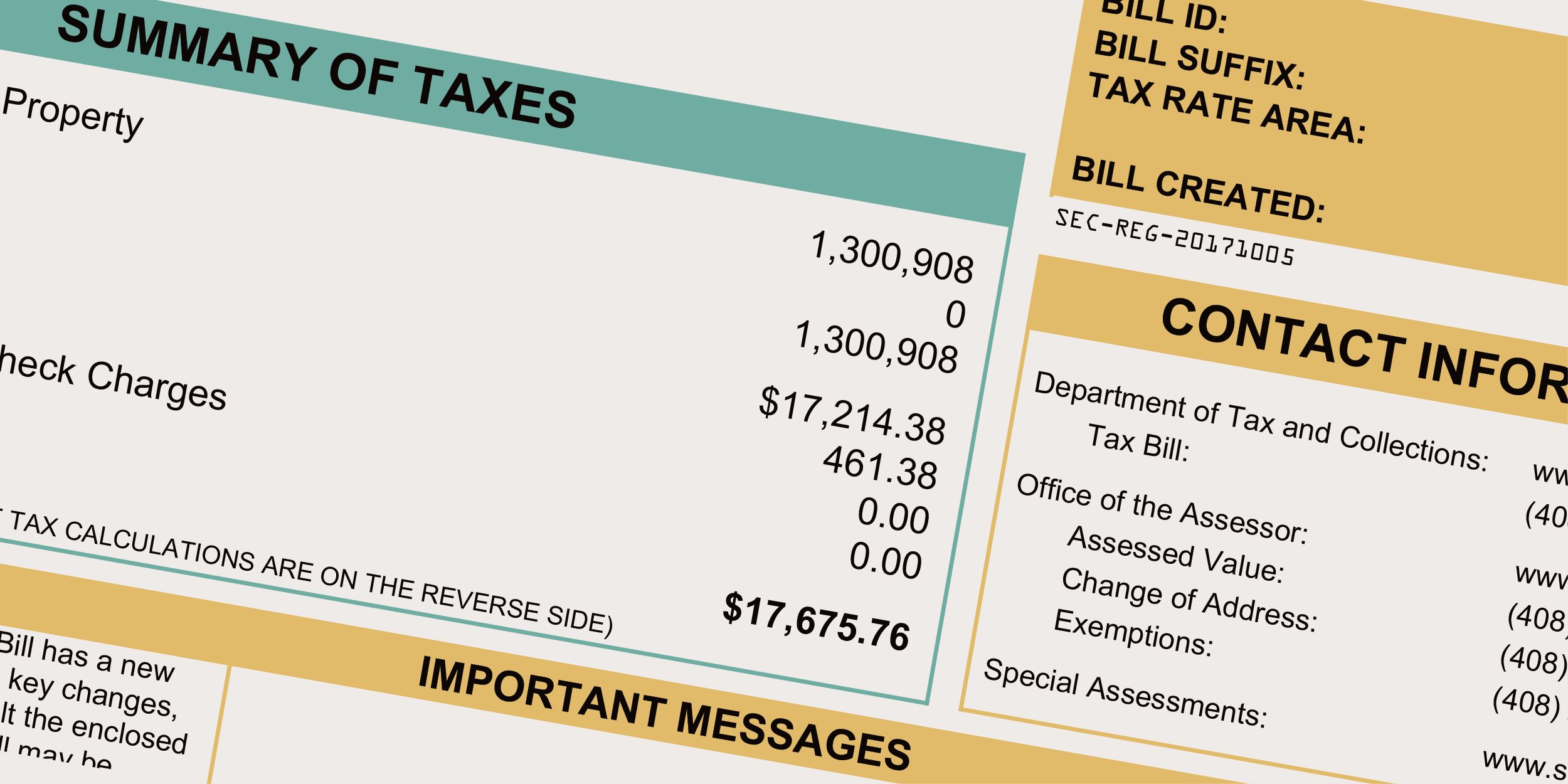

Business Property Statement Filing Period. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Select Alley Avenue Blvd Circle Commons Court Drive Expressway Highway Lane Loop Parkway Place Road Square Street Terrace Trail. To pay Property taxes for Secured property you will need your Assessors Parcel Number APN or property address. Monday Friday 800 am 500 pm.

San Jose CA 95110. These escape bills are usually the result of a taxable event that escaped the Office of the Assessor. Last Payment accepted at 445 pm Phone Hours.

Ad Search Santa Clara County Records Online - Results In Minutes. What information do I have to give to you before I can access the data. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

MondayFriday 900 am400 pm. Closed on County Holidays. Property owners who occupy their homes as their principal place of residence on the lien date January 1st and each year.

Enter Property Address this is not your billing address. Simple Address Search. You can call the Santa Clara County Tax Assessors Office for assistance at 408-299-5500.

Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143. Pay your 2nd installment by April 11th to avoid penalties and fees eCheck payment is free. Simple Address Search.

12345678 Enter Property Address this is not your billing address. You can pay tax bills for your secured property homes buildings lands as well as unsecured property businesses boats airplanes. HOMEOWNERS PROPERTY TAX EXEMPTION.

12345678 Enter Account Number. Santa Clara County Apportionment and Allocation of Property Tax Revenues -1- Audit Report The State Controllers Office SCO audited Santa Clara Countys process for apportioning and allocating property tax revenues to determine whether the county complied with California statutes for the period of July 1 2016 through June 30 2019. The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence.

1 2022 - May 9 2022. PROPERTY ASSESSMENT INFORMATION SYSTEM. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax.

Enter Property Address this is not your billing address. Learn why Santa Clara County was ranked a top 40 Healthiest Community by US. If you have documents to send you can fax them to.

Find Santa Clara County Property Tax Info From 2021. Currently you may research and print assessment information for individual parcels free of charge. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

Uncover Available Property Tax Data By Searching Any Address. All voicemails and emails are responded to as quickly as possible. You can get the information from the Assessors Office located at 70 West Hedding Street San Jose East Wing 5th Floor Monday through Friday between the hours of 800 am.

Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. You can mail your taxes or take a trip to the Santa Clara County Tax Collector to make your payment in person though the city of Santa Clara does not have a particularly remarkable or interesting civic center.

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Info Santa Clara County Secured Property Tax Search

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara Shannon Snyder Cpas

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Santa Clara County Property Tax Tax Assessor And Collector

Understanding California S Property Taxes

Info Santa Clara County Secured Property Tax Search

Secured Property Taxes Treasurer Tax Collector

Assessor Larry Stone Wants Seventh Term

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post